Should I join consulting or investment banking?

Investment banking is an attractive career option for many ambitious graduates. The question is, how does it match up with consulting? To help make the decision between these 2 career paths easier, we've briefly outlined the main differences between the fields.

Apr 11

/

Case Interview Hub

What's this discussion about?

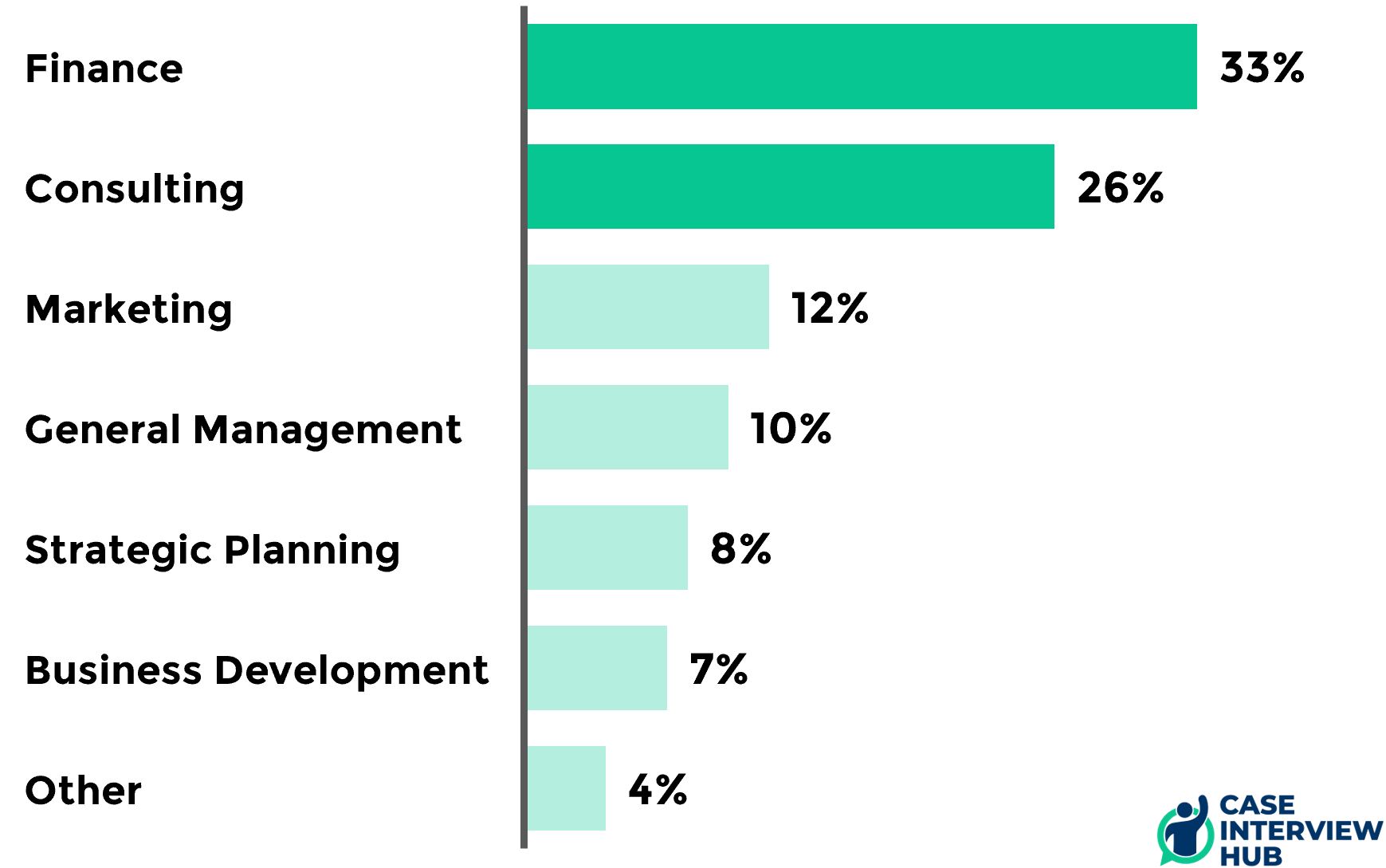

If you're considering joining an MBB firm and have a business background, chances are that you've come across investment banking. In the past, these two industries were the top career choices for competitive students who wanted a steep learning curve, a high starting salary, and a fast career progression. Data from Harvard Business School reveals that more than 50% of the graduates from their 2022 class joins finance or consulting roles (finance also includes corporate finance, PE, VC, and others in this definition):

The learning curve, the salary, and the career progression is what these two fields definitely have in common. But there are also important differences that we want to highlight below.

How different are the jobs?

If you're thinking about focusing on corporate finance or private equity work in your consulting career, the differences to investment banking, especially M&A, can be relatively small. On the other hand, if you're more of a generalist consultant (e.g., focusing on corporate strategy, operational excellence, or digitalization), the job get's extremely diverse extremely quickly.

The decision between the two industries basically comes down to personal preference, and this is just our view on the two industries based on first-hand experience. In consulting, you get to work directly with clients from day one. In investment banking, you hardly get to see clients as a junior colleague. Moreover, consulting offers you the opportunity to explore many different industries and functions. In one project, you may be improving the OPEX at a silver mine in Australia, while in another project, you may be working on a big pharma merger in London. In investment banking, your tasks are much more streamlined to your actual function — if you're in M&A, well, you are doing M&A. Consulting also offers you more opportunities to travel and work abroad, as you're usually located where your client is. In investment banking you also get to travel, but only at a later stage in your career.

The everyday work environment and culture can also be quite different when comparing consulting and investment banking. Investment banking is known for its rough environment. What do we mean by rough? Very direct and often hostile language and pinpointed communication without much fluff. Of course, this image has has also been driven by movies like Wall Street or The Wolf of Wall Street and has changed a lot in the past years. However, some parts of the culture still remain. On the other hand, the communication in consulting is usually not as rough and direct. Upward and downward feedback is part of the consulting DNA and people who are either offensive or use foul language are quickly penalized when it comes to promotions. However, you can also get the investment banking working environment in consulting as many former investment bankers make the shift to consulting. And within those subgroups of former bankers that usually focus on M&A or Private Equity you can have the investment banking work environment. And as you pick and choose your projects and thus the people you work with, you have the choice on what kind of work environment you would like to have.

Write your awesome label here.

Is investment banking actually better compensated?

When it comes to compensation, both careers are very attractive. One of the major differences however is that the compensation in consulting relies more on fixed compensation with a smaller variable share (especially at more junior positions, once you approach Partner level the compensation split changes) whereas the variable share of the total compensation is much larger in investment banking. Overall, compensation is hard to generalize as it depends heavily on your company. A consultant at one of the market leaders will earn more than a investment banker at a mid-level firm. Overall, if you look at the market leading companies in both industries, investment banking will likely have a higher upside if all the bonus targets are met and the full variable share of compensation is paid out. However, in times of market turmoil, investment banking also comes with the downside that there's no guarantee that a bonus will be paid at the end of the year. Bonus freezes are not a fictitious stories — they have happened in the past and will likely happen again in the future (in 2023, Goldman Sachs announced a cut in variable compensation for junior bankers by up to 90% per year, from six figures down to as low as $10,000 per year). So, in years in which the investment bank is struggling you could potentially only earn your base salary, which is significantly below total compensation at top consultancies.

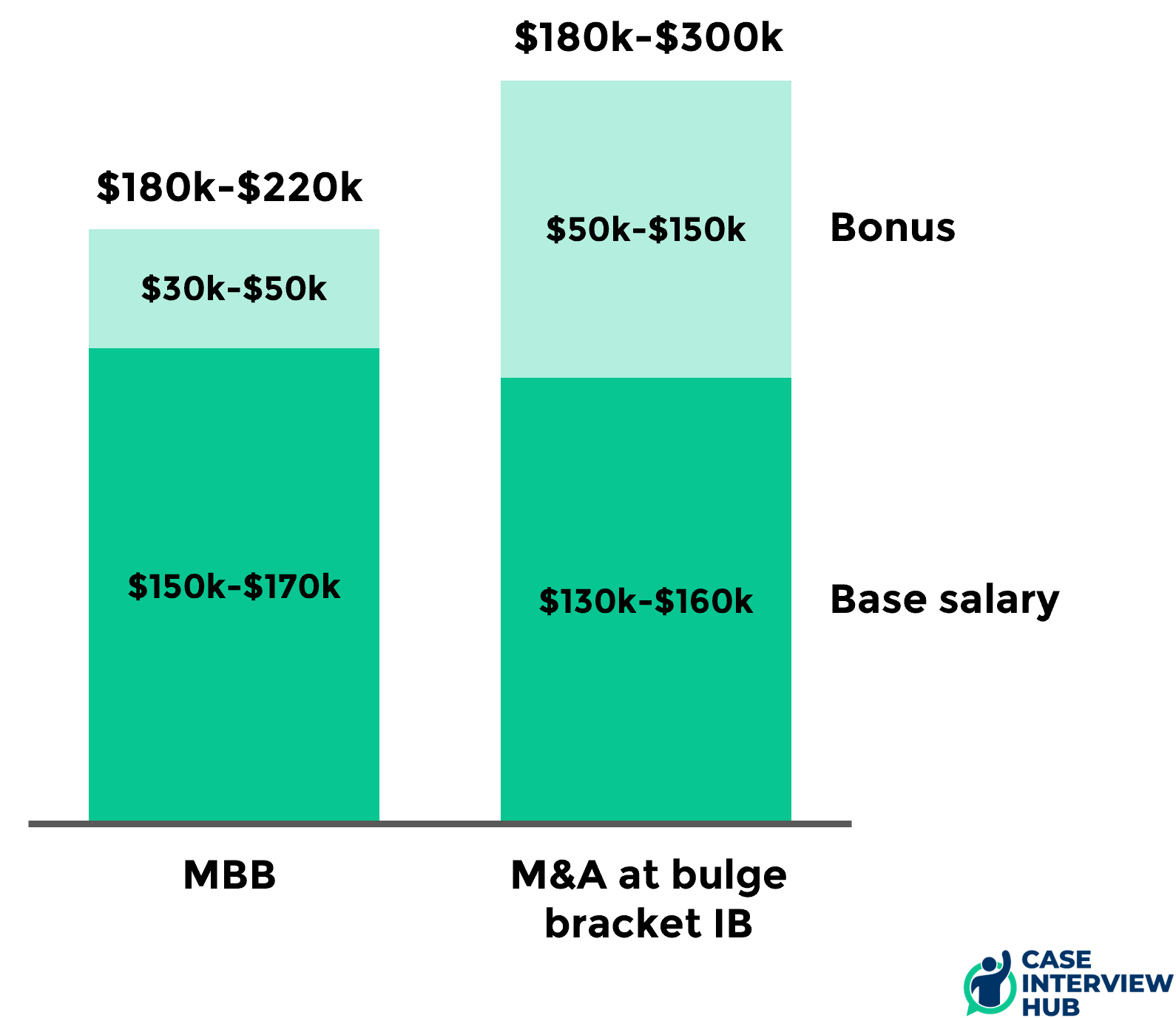

Below you see indicative compensation figures for an associate level (MBA graduate) consultant at an MBB firm and an equivalent role in the M&A division of a bulge bracket investment bank. All in all, the total upside is higher in investment banking. However, given that consulting bonuses are pretty reliable, the downside might actually be smaller in consulting.

To reiterate, these figures are highly indicative. They vary substantially by firm, region, and year. Another aspect we haven't discussed is that M&A investment banking only happens in major metropolitan areas. Most likely, you'll live in some of the most expensive areas within those metros, given that you can't allow yourself a long commute (due to the long hours you're working alone). Meanwhile, consulting firms have offices all over the place. Needless to say, a $200,000 salary goes a long way in the US Midwest, while you won't exactly be rolling in it in Manhattan.

There are surely more factors around compensation we haven't discussed here. It's actually quite a complex topic. In our opinion, compensation should not be the deciding factor between the two industries. Both will offer great career prospects in the long run, whether in the industry or after an exit. It's much more important that the job aligns well with your skills, interests, career and lifestyle goals.

What's the lifestyle like between these two fields?

Related to compensation is the lifestyle question. In consulting, you typically travel to the client on Monday, work hard until Thursday, and then head back home. Fridays are usually relaxed (if there's no SteerCo on Monday...). Generally (if your project doesn't explode), there's no weekend work in consulting — it's actually frowned upon by partners (our guess is that they also want to see their family every now and then). Investment banking is quite different. You don't get to travel that much and are usually bound to your desk Monday to Friday - oh, and then there is the (not so) occasional work on Sundays. Overall, your weekends are much more predictable in consulting.

Are there major differences in skillset between consultant and banker?

The skillset in consulting and investment banking can be very similar — especially if you're focusing on corporate finance in your consulting career. If you're more of a generalist consultant, think of it as follows: you'll become an Excel wizard in investment banking and a PowerPoint wizard in consulting. However, the overall skills are very similar, and both will know how to use either. An analytical approach, compelling presentation of results with top-down communication, and effective teamwork in a high-pressure environment are the characteristics that the two industries have in common. In the end, the choice between consulting and investment banking comes down to personal preference. Both careers are very competitive and offer great opportunities. Many of our team members at Case Interview Hub have experience in both industries, so we know how difficult the choice is.

What are the exit opportunities?

Last but not last, the exit opportunities. In the first couple of years, the exit opportunities for investment banking and consulting are actually quite similar. The classic move for investment bankers, if they do not want to stay in a sell-side role (i.e., investment banking — advising but not actually buying assets), is a move to the buy-side (i.e., institutional investors — actually buying assets). Many junior bankers are eager to join a PE fund as soon as possible. If investment bankers move to a corporate, it's most often in a corporate finance role heading towards the CFO role in the long-term.

The exit opportunities for consultants are more diverse than for investment bankers as the industry is much more diverse. In consulting you could, for example, focus on corporate finance but just as well on marketing & sales. The range of profiles exiting consulting are manifold and no consultant can be compared to another in terms of functional or industry experience. Your project history shapes your exit opportunities considerably, and makes a generalization difficult. The classic exit is usually to more strategy-focused roles at a corporate, with the long-term career trajectory heading more towards the CEO role. Moreover, using the experience gathered in consulting to found a start-up or go into VC is also quite common. Many consultants from the leading consulting firms also make the move into Private Equity (i.e., buy-side). However, the window for this move closes after around 3 years in consulting as it is unlikely that you will join a PE firm after becoming project manager. The reason for that is that the equivalent role at the PE is deal lead and you probably didn't have enough exposure to PE deals in consulting for that role. However, nothing is impossible and we've seen colleagues make that exit after focusing heavily on PE during their time in consulting.