The Consulting Industry:

Tier 1 & Tier 2 firms & what they do

Write your awesome label here.

The consulting industry seems quite opaque for candidates that are on the verge of applying to consulting firms. We shed light on the consulting industry and give transparency on the following topics:

-

What do consulting firms actually do?

-

Why do clients hire consultants?

-

Who are the main players in the industry?

-

How do consulting firms get projects?

-

What is the day-to-day job of a consultant?

-

What are trends in the industry and how are consulting firms reacting?

What do consulting firms actually do?

Speaking on a very high level, consulting firms provide (ideally actionable) business advice to companies, NGOs, and governments. They help businesses and their executives to reach their goals and improve their performance.

Consulting firms usually don't refer to the businesses they serve as "customers" because this term implies that consulting firms are just selling products and are gone afterwards. This is usually not the case. The relationship between consulting firms and the businesses they serve is usually very close and long lasting thus the term used by most consulting firms is "client".

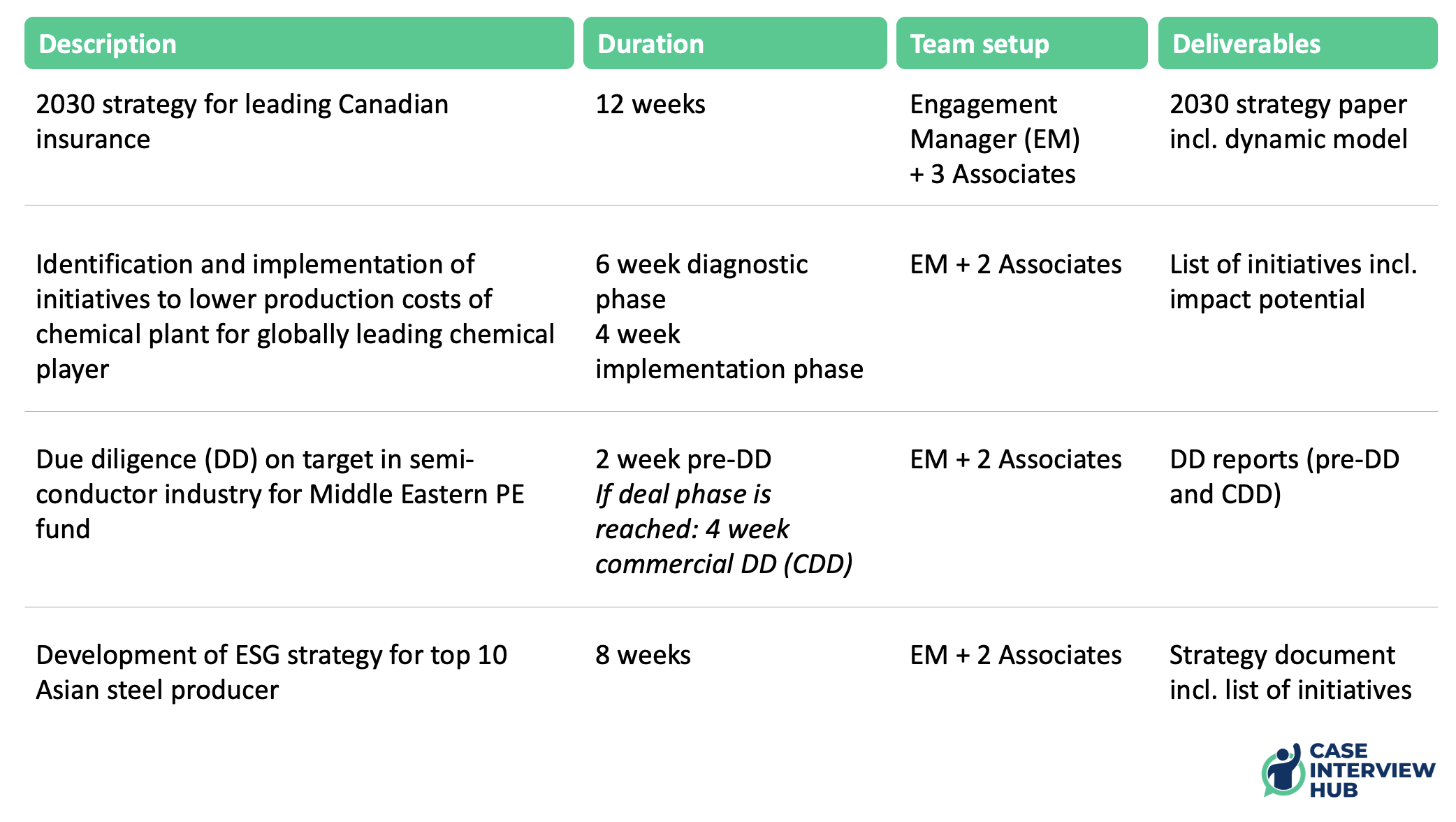

The work consulting firms perform for clients is generally structured in projects. A project is a clearly scoped work package with a (more or less) exact timeline, team setup, and deliverables. Here are some high-level examples of what projects can look like:

This list of projects is of course only exemplary and all aspects can vary widely across different projects. The specifics are closely aligned with the client.

Why do clients hire consultants?

It's one of the most commonly asked questions. What's the point of hiring expensive external consultants if we can simply do it all on our own? An absolutely legitimate question and one that we couldn't have answered conclusively ourselves before entering the industry. However, based on our experience, there are a number of reasons why companies would hire consultants:

Industry experience

Consulting firms bring vast industry experience to clients. One objection to that claim is that the employees at the client have been potentially working in the industry for years and should have a similar level of experience. This is definitely true but many of the employees have only worked at that one company, so they don't have any experience at competitors or even in related industries. Moreover, employees at clients are often restricted to one region or country and do not have global exposure to the industry. They also might have very specialized knowledge in one area and no holistic view on the industry.

The top tier consulting firms have experts (most often partners or senior partners) that served companies in a respective industry across the globe and worked with senior executives of these companies for 10+ years. Let us give you two examples:

-

If a Japanese renewable energy client wants to understand how to optimize the operation and maintenance of off-shore wind plants, the consulting firm can bring in a senior experts that worked with companies in the Netherlands and in California on off-shore wind for the last 10 years. It's likely that these experts can share insights into industry best-practice that will help the Japanese renewable player to optimize operations and maintenance.

-

Another banking client wants to set up a fintech in an adjacent country. They are unsure in which country to launch the fintech attacker first and what the requirements to get a banking licence in each country are. Here the consulting firm they are working with could come in quite handy. They might have experts that helped set up fintechs in multiple countries. The consulting firm can just bring in their expertise and thus accelerate the decision making process.

This second example illustrates another aspect. A company, in this case a bank, may know how the business has been run for the last 100 years. But they typically have no experience with setting up a fintech. They're struggling with their legacy IT and lack the expertise for creating a digital business entirely from scratch. This is where consultants come in. They know what the leading players are doing and how fintechs operate. In all likelihood, they've been involved in multiple such efforts – maybe for a leading bank in another country. So, consultants bring in not only industry experience, but cutting-edge industry experience – which is a significant difference.

Oftentimes projects require specific insights at the intersection of industry and geography. Imagine an insurance client wanting to expand to a neighboring country. Yes, the employees of the client probably know the industry well but what do they know about the neighboring country and potential regulatory hurdles when entering this market? How thoroughly do they know the competition? Here, bringing in a team of consultants with specific knowledge about that market can accelerate the decision making process and speed up the entire project. Also, consulting firms may have senior advisors on their payroll who are former executives from potential competitors in the target market, providing further insights into how to best approach this strategic move. On top of that, the large consulting firms all have research departments in their back office that can serve with detailed market data.

Cross industry insights

Many times clients want to understand how other industries are tackling certain problems. This could help coming up with novel approaches and thus differentiation from the competition.

Imagine your client organization selling a commoditized good and wanting to differentiate themselves from the competition. They may wonder how other commoditized industries manage to do exactly that. Here the consulting firm could just bring in an expert from another commoditized industry and set up a working session with the client to see which best practice approaches look promising and applicable to the client's industry.

But it doesn't necessarily have to be an unrelated industry the client is interested in. It could also be that they need a better understanding of the upstream or downstream business. Imagine your client is a semi-conductor manufacturer and wants to better understand the silicone mining industry to optimize his supply chain. The advising consulting firm could just bring in an expert that has worked with several of the largest silicone mines to advise the client on potential levers to optimize his supply chain.

Validation of strategy

Consulting firms are always brought in to solve specific problems and work on a clearly defined project. However, there is another reason that consultants are brought in — namely the validation of a strategic thrust or holistic strategy.

What do we mean by that? Oftentimes the executives of clients have a very clear idea in which direction they want to take their company. They might look for further evidence and insights from consultants to support that opinion but they also use them to validate their strategy. Let us give you some examples:

-

The CEO wants to expand the business to South America. If her expansion fails after two years, she can always justify her decision by stating that it was recommended by McKinsey and was based on thorough analyses. By doing that she can alleviate the political backlash in her own company and might secure another term as CEO.

-

The new CEO is known for restructuring another company and turning it around. Now he also wants to set a statement at his new company and improve efficiency by cutting jobs and driving digitization. Job cuts are, by their very nature, an unpopular measure and will usually not be supported by employees. However, the CEO can bring in BCG to support. When he has to sell the restructuring to the organization, he can always lean on the BCG analysis. The decision is still his, but BCG provides the ammunition to justify the decision.

We hope these examples make it clear that there can be additional motives involved when bringing in the help of consulting firms.

One additional insight on this point: have you ever noticed that there's usually only bad publicity about (especially) the leading consulting firms? We do, of course, condemn the legitimate scandals like McKinsey opioid scandal or BCG's involvement in Saudi Arabia, which even led to legal issues. But even for issues that are not legally relevant and would only be classified as 'bad advice', the negative coverage outweighs the positive. Consulting firms are discrete and the consultant-client relationship is highly confidential. Consulting firms virtually never publicly release any work they do for clients (and certainly never without the client's explicit consent). Client's, on the other hand, are in most cases free to do and say what they want. So, if a company fails on a major transformation there's an incentive to shift some of the blame onto the consultants. When a project goes well (and the majority of projects does), the client's executives get to take all the credit. This is a privilege that comes with hiring consultants.

Free of internal corporate politics

Soon after starting your career at a corporation, you'll experience that the level of internal politics increases with each step up on the corporate ladder. In case of strong internal politics, client's own strategy departments (in case they have one) may even be hesitant to come up with value creation initiatives that would touch on certain departments or influential managers.

This is where consultants come into play. The consultants' only key stakeholder at the client is the project sponsor. Depending on the nature of the project, the project sponsor is usually a board member at the client. A Consultant's goals is to complete the project successfully and in doing so, satisfying the expectations of the project sponsor. Consultants care about corporate politics only insofar as affects the project's chance of succeeding. Of course, consultants are extremely sensitive to it, and they'll consider this in how to design and introduce their recommendations. But they're not held hostage by an influential middle manager. As a result, consultants are not really participants in corporate politics and much freer than internal strategy departments in proposing initiatives that would step on someone's toes.

Internal capacity & capabilities

There are certain constraints that usually limit clients to execute a project inhouse without any external help of consulting firms:

-

Scope and timeline of the project

-

Required industry insights (e.g., benchmarking)

-

Lack of internal talent

-

Lack of internal capacity (e.g., no strategy department or only bare minimum)

Unless a client employee is explicitly part of an internal department dedicated to strategy or transformation, they'll have a day job and no capacity for project work on top. There's often no way for clients to quickly scale a project by setting up a team of 5 to 10+ people (from project lead to analysts) just from internal resources.

Consulting firms are usually hired to help on projects that are crucial for the success of the client and are often even time-critical. For this reason, clients want to get help by people who are used to working on a tight schedule, know how to structure a project, and are not limited by 9-to-5 working hours. Clients wanting to get the most out of hiring consultants may even set deadlines artificially tight to "squeeze" the consultants and get the most out of them. This can happen at new clients who are hiring consultants for the first time. They might be shocked by the fees and want to get the most bang for the buck. But it may also happen at established clients who are notorious for being a sweat shop for consultants.

Let's face it. It is not uncommon for clients to simply lack the talent within the organization to successfully complete complex projects. Employees at clients are often not well versed in setting up projects and working effectively towards final deliverables. When working with clients, this becomes often clear when they lose themselves in details that have very little relevance to the overall outcome. Or they're afraid of change and just come up with incremental improvements, maintaining the status quo and not stepping on anyone's toes. We're not suggesting that this is always the case, but we've seen it more often than one would imagine over our consulting career.

Having no, or an ill-equipped strategy department can also be the reason why companies hire consulting firms. Of course, this varies significantly by industry, and especially by individual company and its respective history. On the one hand, a company known for inorganic growth (i.e., expansion via M&A) is likely to have a well-oiled strategy and corporate finance department that is experienced in conducting deals in a fast pace. On the other hand, a company that has been growing organically for decades without any expansions in adjacent markets or industries will likely only have a small strategy department that has only been involved in rather operational and non-time-critical projects. The setup and experience of the strategy department can have huge implications on how well a project can progress after the consultants are gone and also how well the company can drive critical projects on their own without external support. Nonetheless, many companies with large and experienced strategy departments bring in consultants to further accelerate a project and to make use of the industry and market insights.

Specialized skills and resources

Especially the large consulting firms have followed industry trends and adjusted their setup and client service capabilities a lot in the past couple of years (see below for more details). They are now able to bring much more than general consulting services to their clients. Let us give you some examples:

-

A traditional banking client wants to establish a neo-broker (i.e., trading platform like Robinhood or Trade Republic). The consulting firm can not only help craft a strategy but also bring in designers to create an optimized customer journey

-

A multimedia client wants to optimize the pricing of customers' advertisements on their platform. The consulting firm not only helps design the new pricing model but also brings in 2 data scientist to create a machine learning model to optimize pricing and maximize ad revenue. Moreover, they also help the client's IT to integrate the model into the IT backbone and enable them to work with similar models in the future

-

An automotive client is undergoing a large transformation to switch to the production of EVs. The consulting firm can not only create a roadmap for the transition but also provide 3 implementation coaches for 9 months (in part-time) to help drive the transformation and make sure all necessary changes are actually implemented

These new offerings (designer, data scientists, implementation coaches, etc.) bring additional value to the client and make sure that consultants can support them end-to-end along the entire project. Back in the day the prejudice against the MBB consulting firms (more on MBB in the next section) was that they come in and define a fancy strategy without ever implementing it. Those days are (mostly) gone.

Who are the main players in the industry?

It's common practice that consulting firms are broken down into tiers with tier 1 being the industry leaders and most prestigious firms. This definition is somewhat artificial, especially once you move past the tier 1 firms. Here you'll find many excellent consultancies that either serve a dedicated niche or have other capabilities that make them stand out. So plainly classifying the firms into tier 1, 2,...x doesn't really do justice to a lot of good companies.

Nevertheless, we try to categorize the firms to give you a better picture of the industry and how you can think about the players. We like to think about firms as either tier 1, tier 2 or boutiques. Let's explain how we define the category and which firms are part of which category in our opinion:

Tier 1

The consulting firms considered as tier 1 firms are the 3 largest strategy consulting firms: McKinsey & Company, the Boston Consulting Group (BCG) and Bain & Company. They have a long history and are considered the most prestigious firms globally. The acronym "MBB" is widely used to label them (McKinsey, BCG, Bain). From an applicant's perspective, these firms are typically the most attractive, given that it's hard to get in (<1% of applicants get an offer), the starting salaries are the highest (even though some boutiques are competitive on this dimension), and the exit opportunities tend to be the best (after a couple of months at these firms, headhunters and recruiters will start contacting you more and more). From an overall perspective, there are a couple of factors that differentiate these firms from tier 2 firms:

-

Size: These firms are simply the largest, and with that come scale effects. Bain has more than $5 billion in annual revenue, BCG more than $10 billion, and McKinsey more than $15 billion (2021). Yes, the Big 4 are much bigger (EY, Deloitte, PwC, KPMG), but their offering goes far beyond consulting services (their main pillars are accounting, auditing, and tax services), and classic management consulting is a minor part of their business.

-

Reach: The MBB firms also have a strong presence in virtually all corners of the world. Given it's size, McKinsey of course leads the pack (130+ offices in 65+ countries), but all the MBB firms are strong in this department. A tier 2 firm often has a few blind spots, or is particularly strong in only one region. If a client needs a new global strategy, you can be assured that the MBB firms have an expert in the respective industry in all major regions in the world.

-

Relevance: The work that these firms do is often decisive for the respective client. If you're betting the farm on a new strategy for 2030, you better go with the most established players. Not only do they have the most experience, but it's much easier escape blame if it fails. Imagine trying to save some money and going with a tier 2 firm. If all goes well, great job. But if you're tanking a billion dollar company just because you tried saving $2 million in fees it's much harder to justify yourself – even if the respective strategies developed by the tier 1 and the tier 2 firm might have been equally valid. That's why the most high-profile engagements for the largest clients and governments are typically done by MBB firms. Also, their publications, their reports, their industry insights, and their strategic thinking are the most frequently quoted among all consulting firms.

-

Support network: Driven also by their scale, MBB firms can afford to build a large support network for their consultants. You'll have dedicated researchers for each region, often even for individual countries. You're going to have dedicated knowledge practitioners for individual industries (you're going to find a researcher for the automotive sector in the Americas at each of the MBB firms). And you're going to have individual units that have built up a certain asset or solution (from our experience, the McKinsey Global Institute, an economic think tank, or the McKinsey Center for Future Mobility as just 2 of countless examples). At tier 2 firms, project teams will spend much more time trying to get a specific piece of information themselves via Google. On top of that, there are many elements that streamline the more menial and day-to-day tasks of a consultant too. For example, the leading firms have dedicated resources (e.g., in India) that will polish their PowerPoint presentations. That way, you can draft a slide, even on a piece of paper, photograph it, and send it to India to be produced over night. There are more examples like this, which all contribute to consultants being able to do more in less time, and in a higher quality.

-

The people: It's almost a self-fulfilling prophecy, and an upward feedback loop: The best people make the best firms, and the best firms attract the best people. If a candidate gets an offer from an MBB firm and a tier 2 firm, it's unlikely that he or she will go with the tier 2 firm. Yes, there are always unique circumstances, but the tendency is clear. And once you go from employee to former employee, there's also a difference. The MBB firms have a tightly-knit alumni network and are the most reliable producers of C-level executives. Their impact and their way of working permeates industries long after the project teams have left the scene.

Tier 2

In our definition, tier 2 encompasses smaller consulting firms (e.g., limited geographical exposure, sector or functional specialization) and the consulting divisions of the Big 4 (i.e., the four largest accounting firms - Deloitte, EY, PwC, and KPMG).

Those firms are not in general "inferior" to tier 1 firms but most of them lack in one or another area. Or to put it more positively, they have certain strengths and focus areas. Some examples:

-

Kearney, Strategy& and Oliver Wyman: They focus mainly on similar projects as the MBB firms, however, frequently not quite on par with them. We've hardly ever seen that those firms outperform the MBB firms with better proposals or pitches in any area except for lower fees. The total salary at those firms in some regions is at the same level of MBB firms although most often with lower or fewer benefits. Nonetheless, the exit opportunities are still very good and we've seen many Kearney and Strategy& alumni secure great exit opportunities in the industry.

-

KPMG and Deloitte Monitor: In general, they focus more on operational and less on strategy work. They have a global footprint and enable some global mobility. However, the main downside is the salary. In many regions the total compensation may only be half of what you'd earn at an MBB firm for an entry-level position.

-

Roland Berger and OC&C: Both firms have a strong presence in Europe (Roland Berger especially in Germany). They both claim to be focused on strategy, yet Roland Berger is most known for its transformation practice.

-

Accenture: The firm is best known for its focus on digitization and IT. We've seen many projects that Accenture won over the MBB firms when it comes to IT integration (e.g., SAP Hana migration). They have deep expertise in technology and if you want to focus on technology and IT while doing less strategy work, Accenture might be a good place to start a career.

Securing a job at one of the tier 2 consulting firm is by no means a bad decision. Still, before deciding for such an offer, you should already consider in which direction you want to go professionally (maybe even with a perspective on your post-consulting career). If you want to focus more on strategy work you should target firms like Strategy&, Kearney and Oliver Wyman and less the operations-focused firms like KPMG and Deloitte. If you want to work globally, Roland Berger might not be the best choice for you. So definitely consider these offers also from a career strategy perspective. The luxury at MBB firms is that you don't have to worry about too much about that, since their strong brands and the great exit opportunities will give you somewhat more flexibility and opportunities for your career.

Boutiques

Our last category are boutique firms. We define boutiques as firms that focus on a dedicated industry or a specific topic. We listed some exemplary firms below, yet the list is much longer as there are tons of boutique consulting firms out there that cater to a very specific clientele. Generalizations regarding salary, learnings opportunities, client landscape or exit opportunities can hardly be made as these depend on the field and specific firm. However, there are some very attractive niche firms on the market that offer a good compensation with a good work life balance.

Starting at a boutique can have its advantages. If you are already very certain in which direction you want to take your career after consulting, it could make a lot of sense joining a boutique. Another reason could be that you already have a very specialized background and would like to keep working in this field.

How do consulting firms get projects?

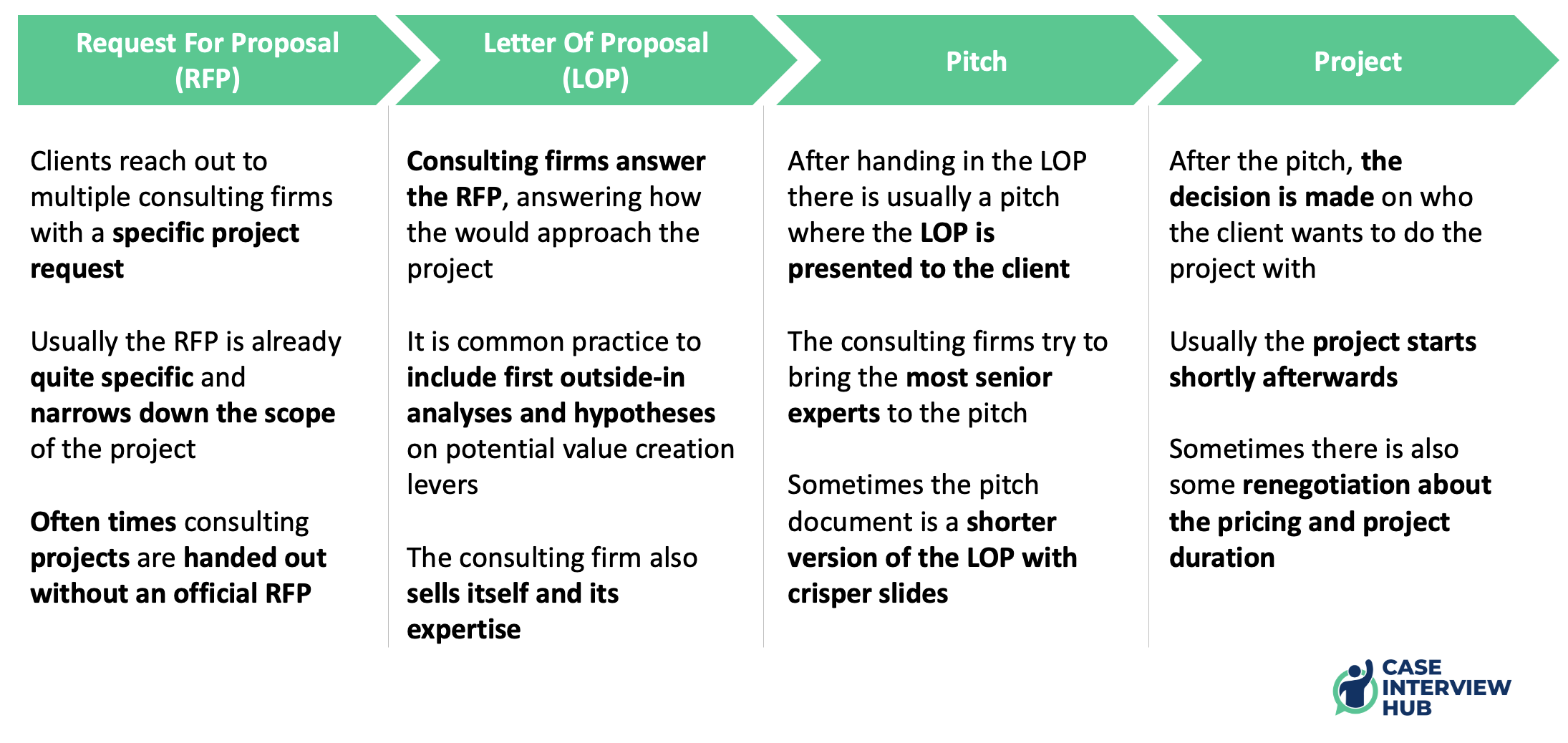

We're talking so much about consulting projects that you might be wondering how consulting firms actually get their projects. At most companies (especially listed ones), there is a formal process in place how they choose the consulting firm for each project. This is to prevent the CEO or another board member from spending all the consulting budget on his "favorite" firm (maybe because he is playing golf with the Senior Partner each weekend) without considering the value for money of other consulting firms. This is even more true for public sector clients, for which there are strict rules to avoid corruption.

The formal process usually starts with a request for proposal (RFP) by the company seeking consulting services for a project. This RFP is usually a Word document that clearly specifies what the project entails and what is out of scope. The level of detail of RFPs varies heavily across firms and projects with anything from a 3 to 20 page document being possible. The deadlines for submitting proposals and the date of the pitch (if there is one) are typically clearly defined.

The answer to the RFP is the letter of proposal (LOP). It is usually a PowerPoint presentation, but it may also be a Word document (if the client specifies that). The LOP answers all the requirements for the project as stated in the RFP in detail. In addition, it's common practice to include first outside-in analyses (if possible), highlight potential industry trends that are related to the topic of the project, and include first hypotheses on value creation levers. Furthermore, a proposed project plan (incl. timeline and what topics are tackled in each phase) and team setup are included. Additionally, what you will find in each LOP is the consulting firm selling itself and its expertise. Often client examples of similar projects that the firm conducted are included in sanitized form (i.e., all sensitive information that would allow identification of the client is removed). Also, there could be a section highlighting the capabilities and tools of the consulting firm (e.g., a novel benchmarking tool). What's not included directly in the LOP is the fee structure. This is usually sent separately and forms the basis for the pricing discussion. Consulting firms are generally willing to take a cut in fees if a long-term client relationship with follow up projects could materialize from this specific project.

The pitch (if there is one) usually takes place a couple of days after the LOP has been sent to the client. Often times it's a shorter version of the LOP looks more like a keynote presentation. Consulting firms usually bring all their "firepower" to the pitch. This means that you'll find the most experienced consultants (i.e., partner, senior partners, and global experts) at the pitch. It's also not uncommon for consulting firms to have exclusive external advisors on a contractual basis. These are usually former senior executives from the industry. They might even be part of the project team for selected workshops, C-level discussions and key presentations. Some clients even want to meet the potential project manager.

After the pitch, the client decides which consulting firm offers the best value for money for this specific project. There may also be some renegotiation of project fees and duration if the firm with the best pitch is too expensive. Fees are sometimes tied to the success of the project. Bain started with success-based fees, but now it's commonplace. It could be that the initial project fee is low and that the consulting firm receives a percentage of the value created. This can be a win-win situation for both, since it lowers the risk for the client and usually increases the upside for the consulting firm. Projects then start shortly after the client decided for a consulting firm.

Quite frequently, the way projects are awarded to consulting firms does not follow a standardized process. Clients and consulting firms find creative ways to avoid having to follow the RFP-LOP process. One option is that new projects are simply sold as follow-up projects/phases to the already ongoing project and thus a new formal RFP can be avoided. Large clients often also have a framework agreement with particular consulting firms which also helps streamlining the process. Another way, especially for non-listed clients or where budget allocation is not as strict, is to simply directly negotiate projects with consulting firms. This is where the consultant-client relationship comes into play. Imagine a senior partner who's friends with the client CEO. Which consulting firm will he select? Skipping this formal process is of course not possible for government entities where requirements are stricter.

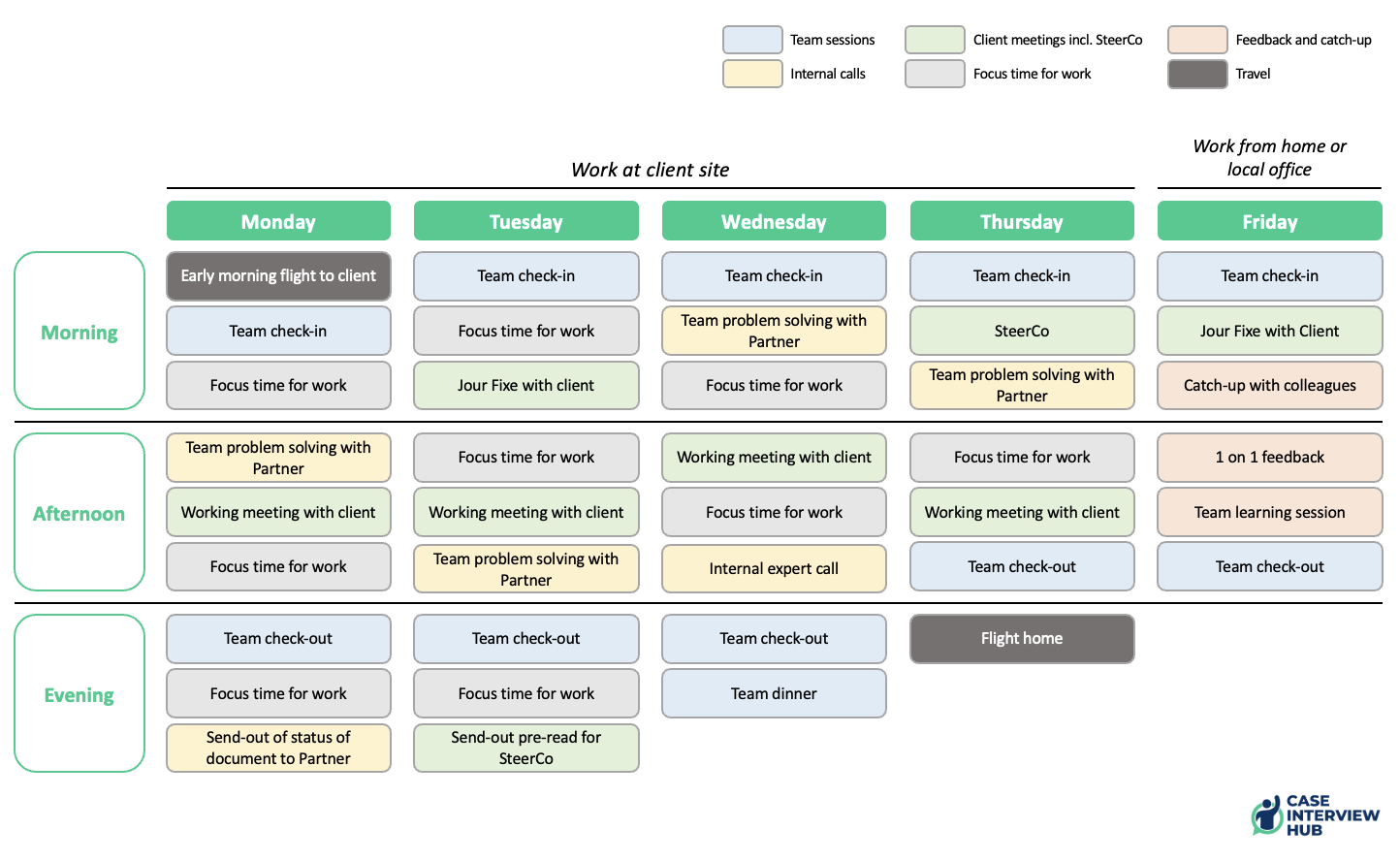

What does the day-to-day job of a consultant look like?

It's hard to describe the typical day or week of a consultant as it heavily depends on the type of project and the preferences of the client. Nonetheless, here we've tried to depict below how a week could look like.

How days and weeks in consulting are structured usually depends on the key meetings with clients. Below we indicated a Steering Committee (SteerCo) on Thursday. A SteerCo is a client meeting with the projector sponsor and senior stakeholders (most often board members) at the client to discuss the progress, insights, and next steps. In the week outlined below, everything revolves around making this meeting a success. The problem solving sessions with the partner will be focused on the content of the SteerCo and how to best present the project to the client stakeholders. Junior consultants will prepare slides highlighting the insights of their workstream and make them fit into the overall storyline of the SteerCo document that is prepared by the project manager and the partner.

The days usually start with a team check-in, where the meetings and tasks for the day are discussed within the operational project team consisting of the project manager and the associates/analysts (the partner usually doesn't participate in these operational check-ins). Over the course of the day there're client meetings (to progress on workstreams), problem solving sessions with the partner (to get guidance on workstreams and expert input), and time for focus work (usually in the late afternoon/evening). Close to the end of the working day, there's usually a team check-out where open topics for the remainder of the day are discussed. Every now and then, if time permits, you will have a team or client dinner.

Fridays are usually less busy and consultants work mostly from their local office or directly from home. Internal calls for feedback sessions and to catch-up with colleagues tend to fall on that day. Aside from content work on project, Fridays are reserved for the remaining admin work from the week (e.g., doing expenses, booking travel for next week). Friday is usually the shortest work day and you will start into the weekend at around 5pm if everything goes smoothly (in places like the Middle East, the workweek may be shifted by a day, so that the week starts Sunday but otherwise everything works exactly the same).

Especially in the post-Covid era, the working mode of consulting firms has changed significantly. Prior to Covid, it was common practice to travel to the client on Monday morning and head back on Thursday evening (as depicted below). Nowadays, the working models have become much more flexible. Here is a list of some of the options that we have seen:

-

Fully remote: depending on the confidentiality of the project and the preference of the client, it could be that a project team is completely remote and might co-locate in an office of the consulting firms (e.g., a BCG team with members from multiple European countries traveling to London each week to work out of the BCG London office Monday through Thursday). This is the standard for Due Diligences (DDs)

-

Bi-weekly: some teams are only bi-weekly at the client site with co-location in other weeks

-

Short weeks: many prefer (understandably) to not travel at 6am on a Monday to the client. Therefore, many teams have flexible models where travel may be on Monday evening and travel back might be as early as Wednesday

The list above is non-exhaustive and aims to just give you an example of which working models are possible. Covid has done wonders to the remote-working-capabilities of many firms, including consultancies. Of course, there are many more options possible and it varies project by project.

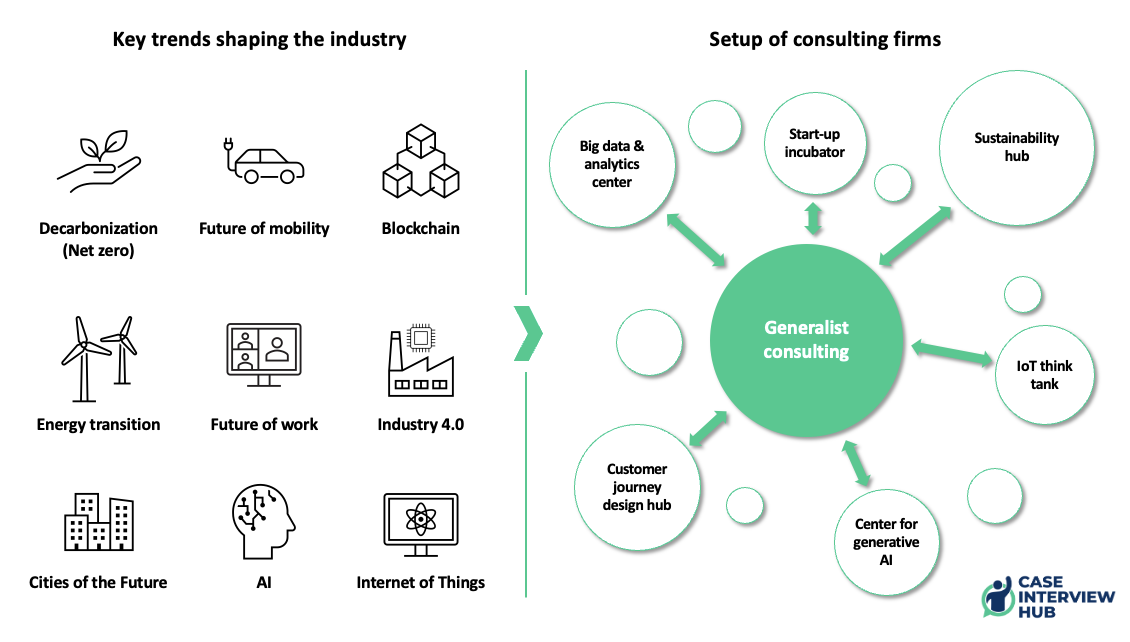

What are trends in the industry and how are consulting firms reacting?

Trends that happen in the overall economy are also felt at consulting firms. In fact, consulting firms help shape these trends. These vary from industry to industry but could range from the electrification of mobility to the introduction of generative artificial intelligence (GenAI) at corporations. Consulting firms are usually at the forefront of those trends, so working there will expose you to the latest thinking. Many clients have heard trendy buzzwords too, and wonder how they could impact their business. For a consultant it's always good to have a basic understanding of the latest trends so that at least the first, and most high-level questions of clients can be answered. A great example is the trend around GenAI. Within weeks of the concept gaining mainstream popularity, consulting firms published first major reports on it, almost as if they invented the thing. And of course, they're coming up with calculations of the trillions of dollars in global value creation potential which can be unlocked by engaging their services (just a few examples to be found here, here, and here).

The industry trends also changed the setup of consulting firms. Back in the day, consulting firms heavily focused on generalist consulting. All the firms were divided up into industry (e.g., banking, automotive, chemicals) and functional units (e.g., marketing & sales, corporate finance, operations). Nowadays, generalist consulting is still the centerpiece for large, established firms. However, the leading consultancies have branched out and set up a variety of knowledge hubs within their firms. Be sure that all all the tier 1 firms have specialized hubs for advanced analytics, sustainability, design, and so on (and tier 2 firms are trying to keep up).

These trends have also changed how project teams are set up. Back in the day, teams of generalist consultants were the norm. Today, most projects encompass at least one element that requires additional help from specialized consultants or experts. It's not uncommon for projects to have one generalist, one data scientist, and one designer in the core team. This helps the client organization with new and useful capabilities, but also allows the generalist consultant to learn from these experts. If they broadly fit the profile, generalist consultants may even have the option to switch to other consulting tracks within a firm. For example, if someone's interested in sustainability he or she can join the sustainability hub, focusing solely on that topic. You may not work on client projects 100% of the time anymore, but you may get to work on internal knowledge topics or tools that can be helpful in future client engagements.