Is it worth spending money on case interview preparation?

People spend thousands of Euros on their college education yet often neglect preparing to get their dream job. Does this make sense from a financial perspective? The short answer is: YES! The long answer is more complex and as so often in life: it depends!

Jul 21

/

Case Interview Hub

Potential cost of interview prep

The first expense that anybody might incur is for interview preparation books. Not all of them are good, but with $20 spent, there's not much lost. However, books alone won't do it, and friends are often no help. That's why many candidates turn to professional help.

There's a vast array of offerings, some are more, some are less legitimate. Many candidates willing to invest in this process will hire a coach (hopefully a good one). That will set them back at least $200 for a singular coaching hour, potentially significantly more. And one hour won't do it for most people. In our experience, while quality of practice is more important than quantity, even good candidates need at least 10 cases under their belt. They don't necessarily need to be with a coach, sure, but it's easy to see how candidates spend a 4-digit sum on coaches. And some candidates even join some sort of coaching program, bootcamp, academy, or whatever you want to call it. That typically consists of some learning materials, a few group sessions, and a few interviews with a professional coach.

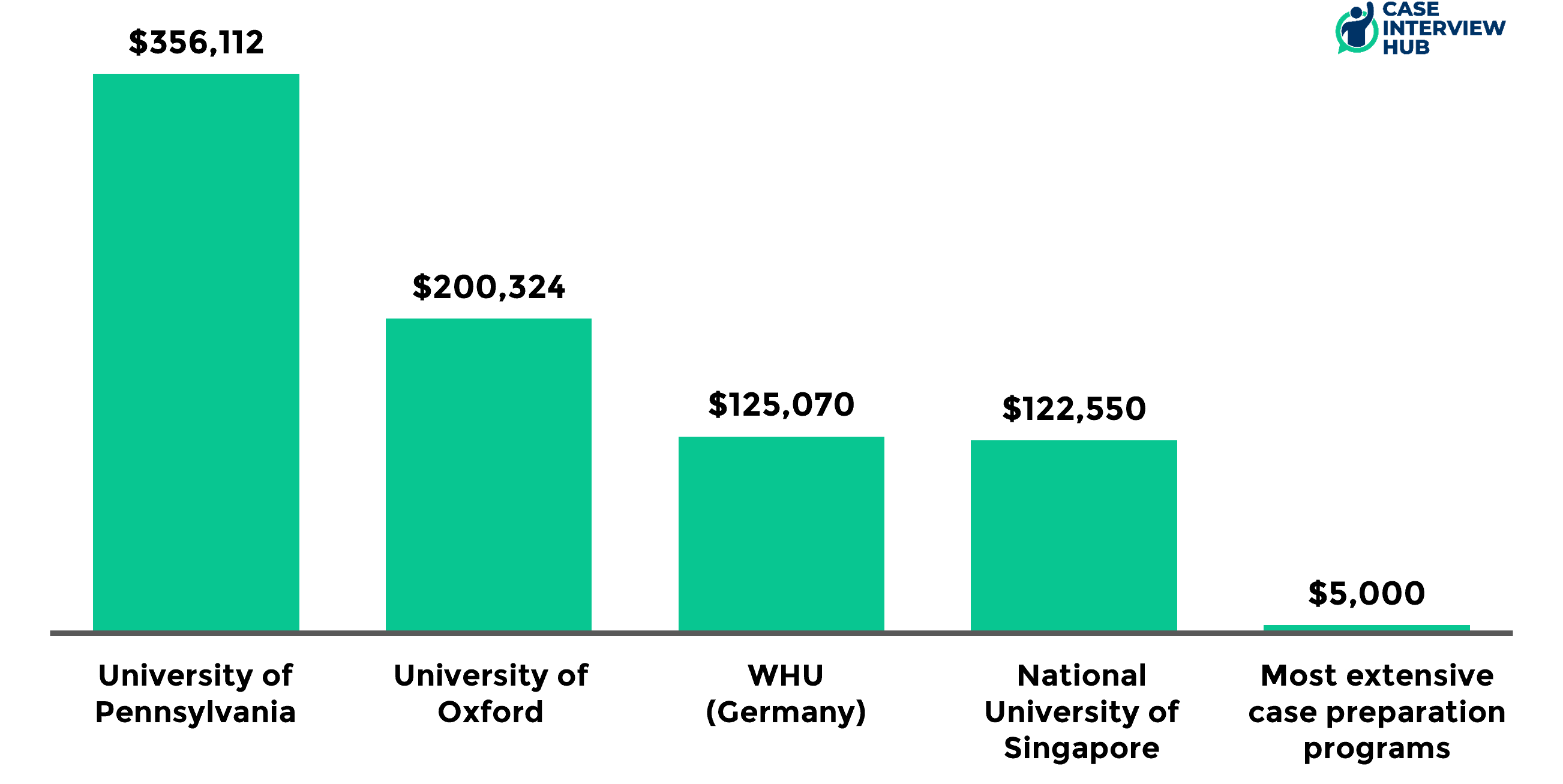

All this adds up, and some candidates are willing to spend up to $5,000 for different coaching programs. For most people that's a lot of money. But then again, how much is it really? Below we compare that to the cost for an undergraduate program in the business & economics divisions at well-respected universities around the world (classic target universities). We've computed the current tuition, fees, and living expenses for a 3- to 4-year undergrad program in the economics and business division (for international students, before any aid, and assuming no inflation).

It becomes immediately apparent that education is the biggest investment that a lot of people will make in their life. And yes, there are way more cost-effective, or even free schools out there. And yes, you may get some financial aid. But even if you study for free, cost of living alone over a 4-year program will easily exceed $50,000. Not to mention the opportunity cost that you incur by not working for 4 years.

Surely you'll get a great education at these institutions, but none of them will provide you with any guidance on how to pass a consulting interviews. That's why many candidates aren't blinking twice when it comes to investing in interview prep: 'Why spend $100,000 on a degree, and then be too cheap to pay $1,000 for laser-focused practice so I can get my dream job?' - that's the rationale.

Potential return of an MBB job

Consulting can be a lucrative career. Next to some jobs in tech and finance, consulting offers among the best starting salaries and steepest career progressions. If a corporate job is the alternative, consulting will almost certainly be the better option when it comes to compensation.

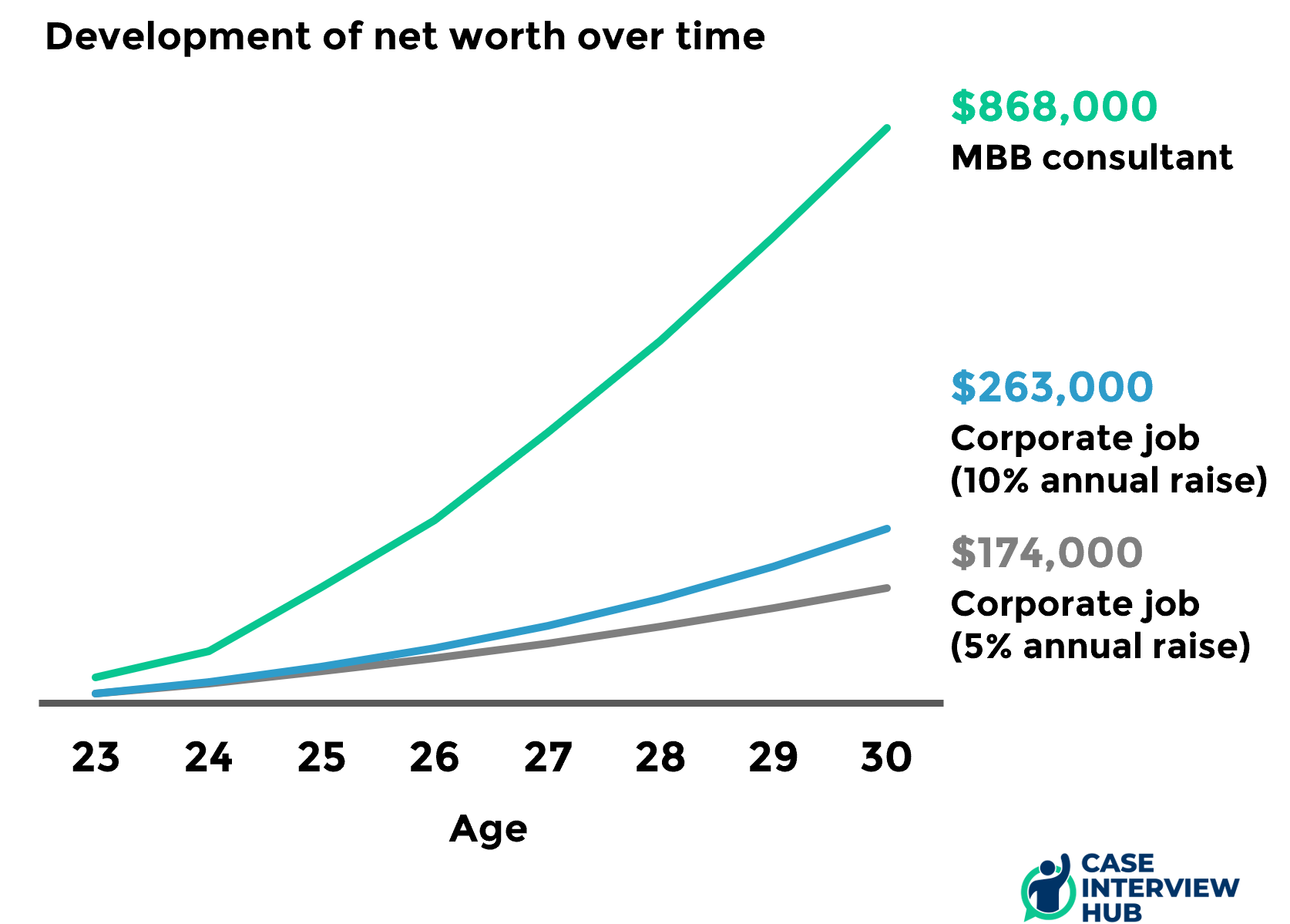

The National Association of Colleges and Employers (NACE) projects starting salaries for undergraduates with business major at around $61,000 per year in 2022. Add to that a generous variable component and we're at $70,000 per year. Meanwhile, entering an MBB firm as an analyst will pay at least $100,000, probably closer to $110,000. After 2 years that person will reach the MBA-equivalent, closing in on $200,000 per year. And after 2 more years that person will be a Project Leader or Engagement manager, easily exceeding $250,000 per year.

Let's set up a hypothetical comparison of regular job vs. top consulting job. Our fictitious person lives in Philadelphia, is single, and starts working right out of undergrad. The corporate job will pay $70,000 per year and include an annual raise of 5-10%. The consulting job will pay $110,000 and then take the trajectory described above. Deducting from that the taxes, cost of living, and a basic healthcare plan leaves us with savings in year 1 of $14,000 for the corporate job and $39,000 for the consulting job. Assuming we invest all that in the stock market at a 5% annual return, this is how the net worth of that person develops.

By the age of 30, an MBB consultant's net worth may be at least half a million dollars ahead of corporate peers. Yes, he or she will have worked more and in a more hectic environment — but that's what ambitious people are ready for. By the age of 40, we're talking already about multiple million dollars. These assumptions are all quite conservative. For example, we assume that the consultant simply stays at project leader level. If instead he reaches partner level the whole calculation looks entirely different again. All that is not to say that a corporate job can't lead to a successful career. Yes, climbing the corporate ladder all the way to CEO is possible. But even here the consultant is ahead, as he'll skip multiple steps on that ladder (as evidenced by the vast number of MBB alumni among corporate executives).

The bottom-line

Bringing it all together, it's easy to see why interview prep is popular. It's a minor addition to an already expensive education. And it may open up the door to an entirely new career. Not a career that's 10% percent better. A career that may be 10x better. And that's a real difference of millions of dollars over your career. Of course, no interview prep will guarantee success. But it may just be the best lottery ticket that you ever bought. A 20% higher chance for making it into the top consulting firms for just $1,000? These are odds we'd take.